The Federal Reserve's inflation quandary.

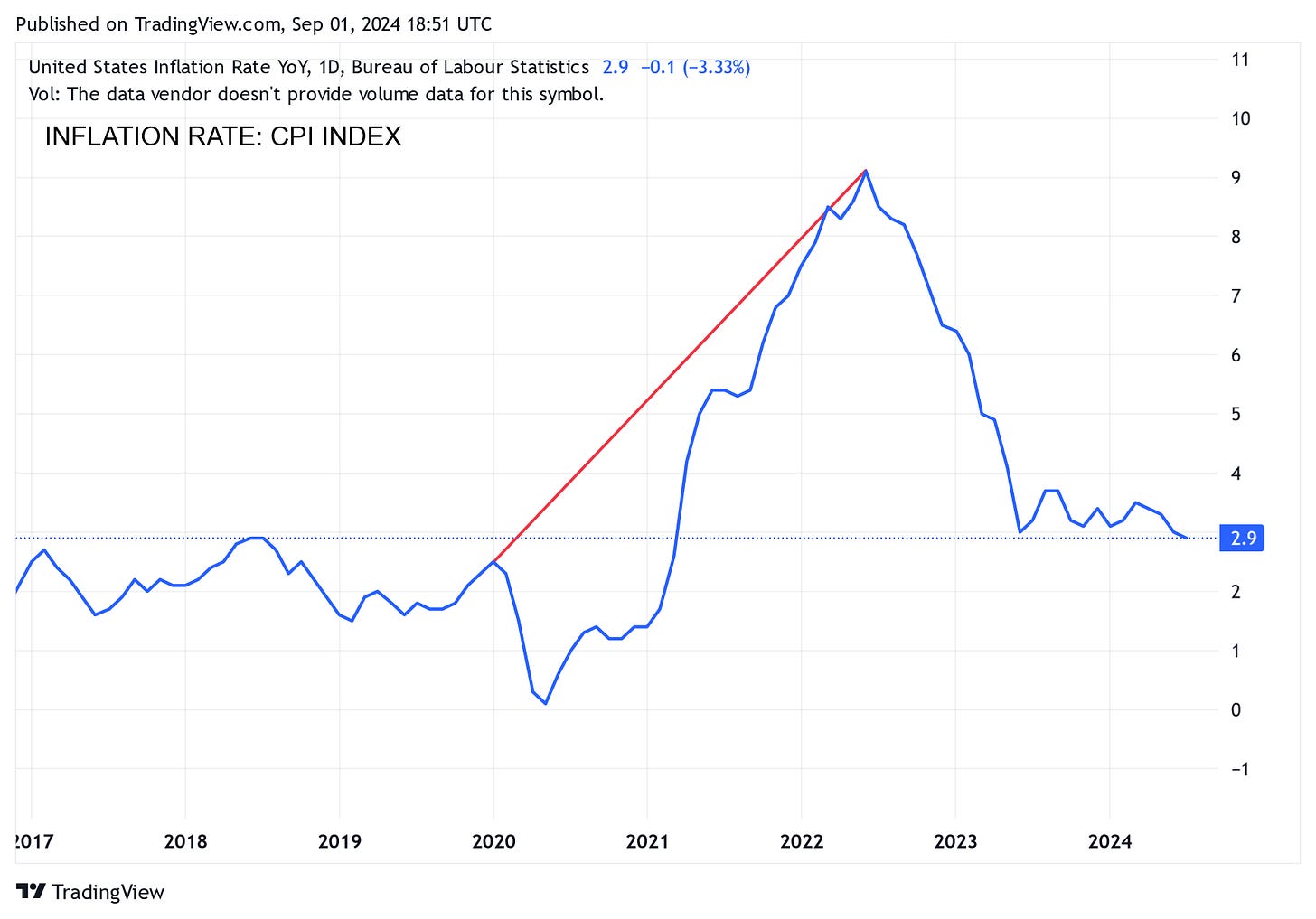

A look back to the inflation peak in 2022 by monetary policy enacted in 2020.

Precursor to the storm.

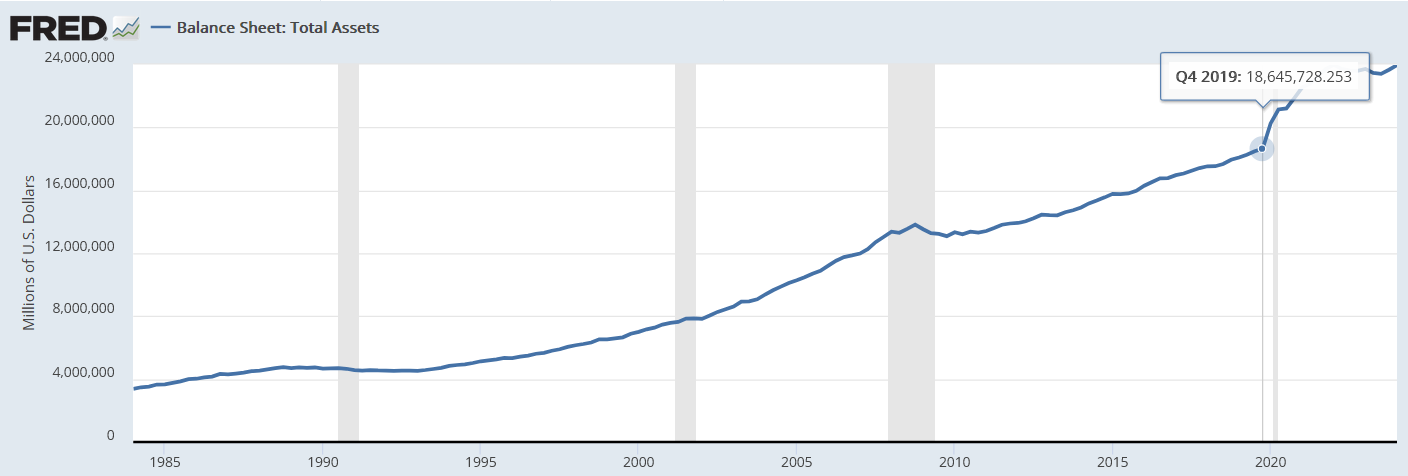

January 2020, a new year reborn with unprecedented world events waiting to be unravelled. The last quarter of 2019 showed that the Federal Reserve sat on $18.6 trillion of total assets, a steady growth since the 2008 subprime mortgage crisis.

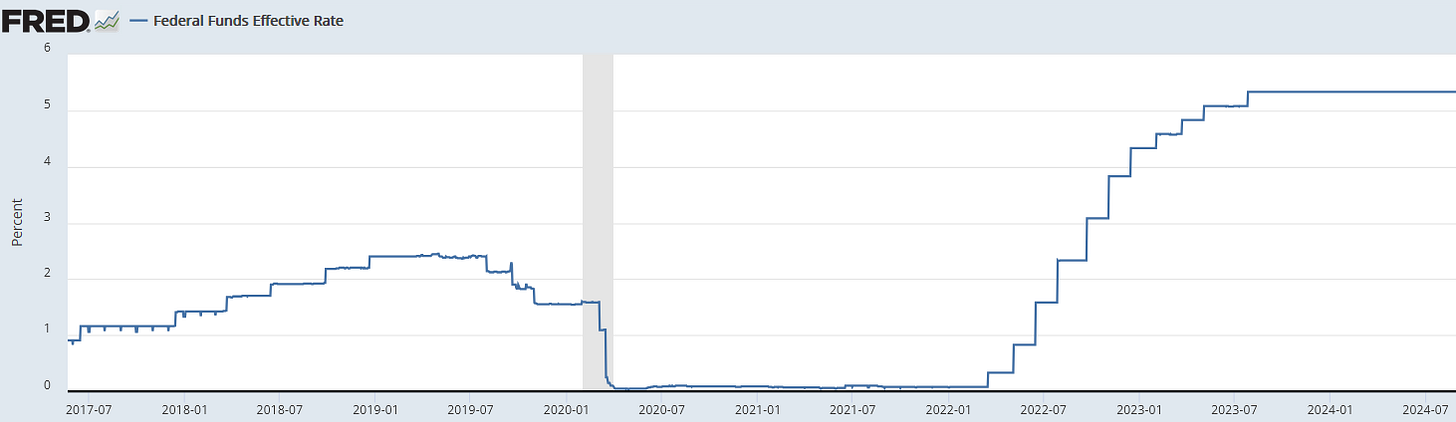

In the month of March of 2020, the infamous Covid-19 shutdown the world economy with the powerhouse of the United States being no exception. Commerce came to a halt, supply chains choked, and an economic impasse emerged with an no clear direction. The Fed immediately responded the same month with quantitative easing; purchasing of asset classes composed of US treasuries and mortgage-backed securities. This was one of the first policies that led to an influx of money creation by making money more available in the economy which caused interest rates to drop at near-zero levels.

At the end of 2020, the Fed added $3.2 trillion to its balance sheet.Jannuary 2020, federal fund rate = 1.55%

March 28th, 2020, federal fund rate = 0.10%

From March 2020-2022, interest rates would be near zero

This was the first turning of the mechanism. When the Fed buys assets from the open market, it has go-to buyers composed of large banks and other financial institutions, which are entrusted by approval. Think of these approved buyers as intermediaries to the monetary policy. When the Fed initiates QE (quantitative easing), these intermediaries are vital in completing the process.

As these large banks collect money from the Fed by selling their bonds or mortgage-backed securities, the reserves of these large banks increase. As bank reserves rise, this becomes the driving force for money creation as banks now have more money to lend out. This effect cascades into the greater economy as money becomes more abundant. All that money is lent to home buyers, businesses, and everyday consumers which ultimately drives economic growth.

Bank reserves - cash holdings held by a bank; banks are required to hold a minimum amount of reserves at all times.The acceleration factor.

Fractional reserve banking has been abandoned in the past after the pandemic. It was a system that facilitated borrowing among banks within their local economies. By allowing banks to lend out more money than actually kept in reserve. A law that had been the standard for the last 150 years.

Reserve ratio - the percentage of deposit that must be kept in cash as a reserve in case of customer withdrawal.Hypothetically, if the reserve ratio was 5% and a customer had just deposited $100 into his local bank then that bank would be required to always have at least $5 on hand, no exceptions. The other $95 can be used for investment opportunities, lent to borrowers, or any other leveraging. If you envision this on a scale of millions of consumers and only a couple of banks, it can seem quite precarious.

A 100% reserve ratio would imply if every customer demanded to take their money out at once, the bank would have it all available.

Such a ratio is unpractical but drives the point home.

Many economists critique fraction reserve banking as its biggest vulnerability being a bank run. If such an event were to happen, even a bank with a healthy capital ratio would go bust. As there is just not enough time to liquefy total assets as customers are withdrawing all their money almost instantaneously. This is assuming that the bank is extremely conservative with its leveraging.

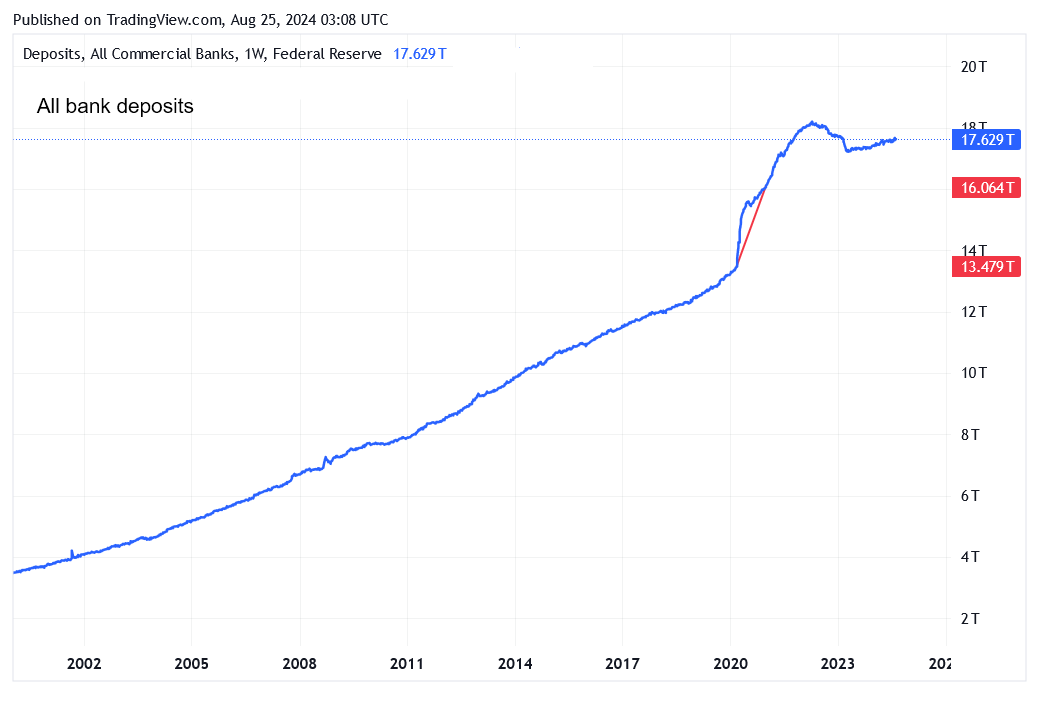

Capital ratio - the percentage of a bank's capital to its risk-weighted assets.Nonetheless, on March 15th, 2020, the Fed announced a reserve ratio of 0%. Which now meant that banks were no longer required to hold any money in their reserves and were able to lend out all their cash. The Fed’s intention was to bolster the economy as people were not spending and saving exuberantly, made evident by the bank deposits.

Speaking of which, bank deposits spiked as Americans were not able to spend in a locked-down economy. This is where the vernacular expression “printed money” originates from. Although, it is utterly erroneous to believe that the Fed as a single entity physically prints all of the money into the economy. A combination of QE and 0% reserve ratio equates into a tremendous injection of money into the economy.

Banks were now able to leverage and loan out entire reserves, this lead to an over 35% increase in aggregate bank deposit growth, the fastest in recent history.

Bank deposits - money kept or held in bank accounts for saving or interest.March 11th, 2020: bank deposits = $13.479 trillion

December 30th, 2020: bank deposits = $16.06 trillion

Fun fact, more money was bottled up in the US economy than the size of China’s GDP ($14.7 trillion in 2020)

This hawkish policy poured monetary gasoline on the inflationary fire. As regional banks were now able to lend out at record levels. But once again, during a time where commerce virtually stopped dead in it’s tracks.

In macroeconomics, the leading theory for money creation states that banks create new money when creating loans. If bank A loans out deposits from customers to bank B, bank B can now loan out their borrowed money to bank C, and so forth. A perpetual cycle which can be calculated using the money multiplier effect.

Most money is created by commercial & regional banks, not the Federal Reserve

Ultimately, this phenomenon expands the bank deposits rapidly.

This is all occurring during a time when Americans are worried, demand is climbing (due to newly created money), and supply is stagnating (consumer spending down 2.7% from 2019-2020).

Monetarism says look at the money supply.

Despite what the politicians, radio, or corporate news is telling you with various theories to understand why inflation spiked from the supply chain to the oil reserves being drained. When in actuality, the strongest case can be accredited to the Monetarist school of thought. The philosophical premise of Monetarism would argue that economic growth can be optimized through the amalgamation of the money supply. In other words, money is the lifeblood of an economy; it is to say that too much or too little can cause serious damage.

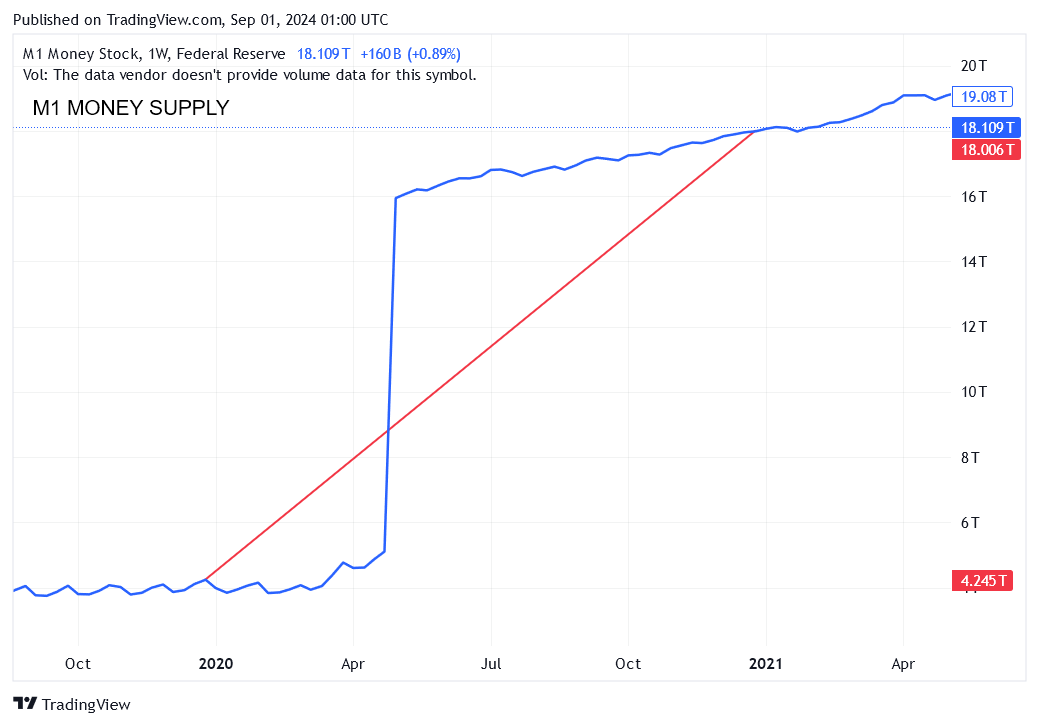

When primarily studying the M1 money supply, in December 30th, 2019, the M1 was at a balance of $4.2 trillion. In a lapse of single year, the M1 reached an immense balance of nearly $18 trillion in December 28th, 2020. A meteoric 329% increase in the money supply.

M1 - the count of all notes and coins in circulation (an estimate of aggregate cash, chequing, and saving account deposits).The M1 money supply peaked to exactly $17.989 trillion for the year 2020

Total peak reached to $21 trillion in April 2022

That’s more than the total amount of gold above ground = $12 trillion

And the entire market cap of the cryptocurrency markets = $2.3 trillion (April 1st, 2022)

Combined together…

The point of no return.

Now, such an unprecedented and drastic increase in the money supply subsequently increases demand as buying power rises, combined with a quarantined economy halts virtually all markets due to public health mandates. This causes the supply of nearly all goods to stagnate for a whole host of reasons; such as mass layoffs across the country, businesses filing for bankruptcy, overall energy consumption decline, general fear and anxiety, and supply chain complications.

In the end, what happens if demand rises and supply falls? Inflation. Leading to the inflation peak of 9.1% in June 2022.

CPI (consumer price index) - the average change in the prices paid by consumers for a market basket of consumer goods and services.CPI rate for January 2020 = 2.5%

CPI rate for April 2022 = 9.1%

Current CPI rate for July 2024 = 2.9%

There is more nuanced discussions to be had with other factors that led to the inflationary period of 2022 such as the Russia-Ukraine invasion, CARES Act, and a overheated labour market. For the sake of your time, it will be left out for another time.

Overreaction by the FED?

I’ll leave this one for you as the reader to decide. Regardless of politics or diverging views on monetary policy. One thing is for certain, the sentiment of most Americans is frustration from lack of affordability in their every day lives. Do you believe the central banks were too aggressive in pumping money into their respective economies?