A prologue to option derivatives.

A rundown of one of the most riskiest yet upside potential equity derivatives.

Options are a formidable instrument as they have the potential to sink a billion dollar hedge fund while also having the potential to strike gold. A typical option contract represents 100 shares of a stock and can be bought for a fraction of the price. Furthermore, if the underlying asset (stock price) were to move in your favour then your profit potential is that of 100 shares without tangibly owning those 100 shares. Due to this pricing feature, option contracts have massive upside potential and adding leverage into the equation further accentuate profits. We will discuss an example later to illustrate this.

Risk is everything.

Although, there is obvious and incredible risk to options. And the trouble begins for many traders when realizing the jarring complexities of the option markets. The lifeblood of options is liquidity, without liquidity, trades can not be executed successfully, especially in a market with millions of trades occurring at once. This is where market movers step in, an entity that pumps liquid into the markets by filling buy and sell orders in the magnitude of millions of dollars.

To put it succinctly, the three most important variables to consider for establishing an option strategy is; implied volatility, movement in the underlying asset, and time decay. As these three assemble the evaluation of an option contract (the price you are willing to pay for).

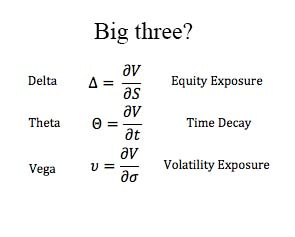

The moment you purchase an option, it begins its countdown until expiry on its maturity date. Declaring time decay which is measured with Theta. In addition, an option’s sensitivity to price change from movement in the underlying asset, is a parameter that can be measured with Delta. Lastly, how the option reacts to change in implied volatility in denoted with Vega.

There are of course more parameters that measures the risk an option, but for the sake of this article, I will encompass it down to these three Greeks.

Trading with the whales.

In biology, there are observational symbiotic relationships that larger animals hold with smaller ones. One of my favourite examples is in Sub-Saharan Africa, where the Nile Crocodiles and Plover Birds have a fascinating interaction that is opportunistic for both species. The bird scavenges leftover meat stuck on the Nile Croc’s teeth which acts as a dental cleaning and a meal for the Plover Bird. Proving mutually beneficial.

You often see this sentiment in the trading world, where retail traders try to emulate the trades of politicians or hedge funds. The biggest downside to this method is variable lag. Meaning that there is a substantial grace period (usually 30 days) where the politician or firm has to make trades available, rendering the trade log useless.

Sometimes this is done more implicitly where typically investors become bullish when the Fed begins to cut rates as it is indicative of booming markets. This is where the famous “don’t fight the Fed” phrase comes from as betting against what the Fed does typically won’t work well in your favour.

My intention is not to discourage new traders from entering the markets but rather warn of the risks and illustrate who you really are up against. Hedge funds composed on smart people working as a collective; PhD’s working in research, engineers working in risk management, strong math-quants in trading, and different desks focused on different instruments. One desk focused on options, one on gold, another on futures, and so forth. In some instances, one desk can be purely concentrated on a specific derivative for a precise company, such as exclusively trading call options for NVIDIA.

Quintessential profit potential.

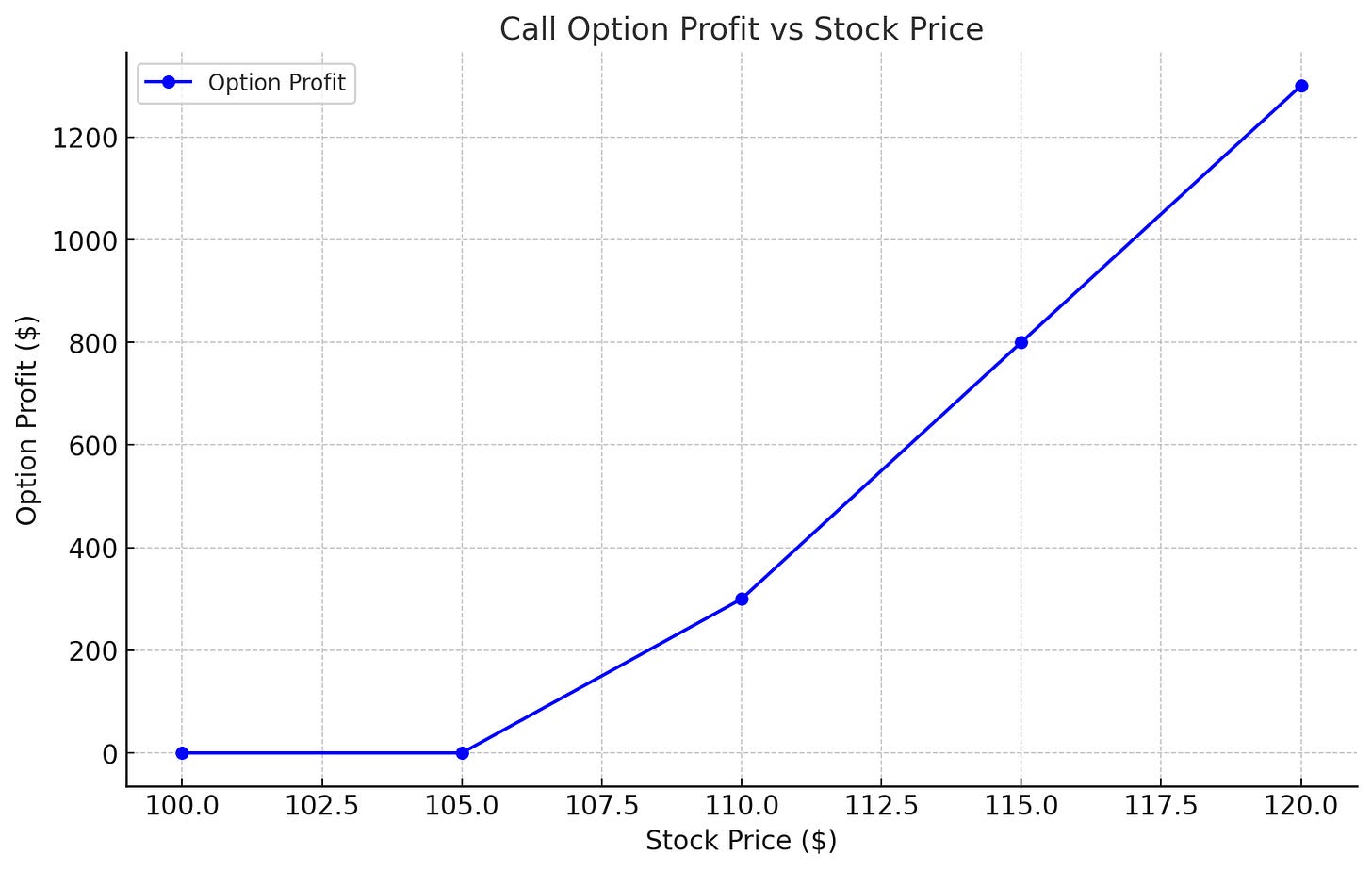

With the help of AI, we are able to simulate a hypothetical option trade to demonstrate the profit potential. For simplicity’s sake, we are using low amounts, always keep in mind that hedge funds are trading on the magnitude of millions of dollars at their disposable. Now, let’s imagine the following.

Strike price - the price at which an option is purchased at.

Option premium - the price of what the buyer pays to the seller (the cost of an option contract).Company A has a stock price of $100/share. The current strike price for a call option is $105. You are fairly optimistic on your trade and decide to purchase 1 contract. You decide to purchase the contract, the option premium is $2 per share or $200.

So, you now have 1 option contract which you purchased for $200 (ignoring broker commissions, taxes, and interest rates).

Your current position: $200 = (100 shares * $2 premium)Now, say that the company releases profits for the first quarter and they smash investor expectations. The underlying asset (stock price) soars from $100 to $120. That means that you are now up $15 per share, but, you are not holding a stock, you are holding an option contract which gives you the right to 100 shares. Thus, your initial $200 investment is now worth $1500. Generating you a 650% return.

If the stock price where to drop below your strike price, it would render your contract useless at expiration.

Profit = (120-105)*100 = $1500

Where, current price = $120, strike price = $105, call option = 100 sharesThe bottom line.

The truth is that raw intellect is not enough to be profitable in the markets. Especially, as the financial markets become more mathematized since the 1990s with the pioneer, Jim Simons, introducing dense mathematical and statistical models applied to evaluating price, volatility, and other option technicalities. As time goes on, it will be progressively harder to outperform the market especially as language models continue to become ubiquitous in the markets. A machine can execute hundreds of thousands of trades faster than you can blink.

In the end, any curious individual wanting to enter the arena of option derivatives should understand who they are up against, the dynamics of the markets, be diligent and patient, and most importantly understand risk management.